Corporate and M&A – Page 14

-

Article

ArticleUnbound raises funds for its growth

Hotter Shoes’ parent company, Unbound Group, raised a gross £3.3 million by selling 22,004,615 shares at a price of 15 pence each in a placement. In addition to the placing, certain of Unbound’s directors and senior managers subscribed for 1,221,281 shares, under a subscription scheme, at a similar price and ...

-

Article

ArticleCoats takes over Texon as it expands into footwear

The British industrial thread manufacturer Coats is significantly increasing its presence in the footwear industry with the acquistion of Texon, a U.S. footwear solutions provider. Coats is buying Texon at an enterprise value of $237 million and a total net cash consideration of $211 million. The acquisition is based on ...

-

Article

ArticleKohl’s terminates talks to be bought by Franchise Group

The U.S. department store retail chain Kohl’s has put an end to talks to be taken over by the Franchise Group (FRG) at $60 a share. The offer valued Kohl’s at about $8 billion. Kohl’s said that its board “unanimously determined to conclude its strategic review process. The current financing ...

-

Article

ArticleMoncler sees footwear representing 10% of revenues

Moncler expects footwear to represent 10 percent of its revenues in 2025, driven by demand for luxury sneakers in the U.S. The Italian luxury goods brand, known for its down jackets, generated sales of €589.9 million in the first quarter of 2022, up a reported 61 percent on the year ...

-

Article

ArticleAldo’s North American creditors approve its restructuring plan

Aldo Group said that its North American creditors have voted in favor of its restructuring plan, almost two years after the footwear and accessories company filed for protection under Canada’s Companies’ Creditors Arrangement Act. However, the outcome of the procedure remains conditional to the creditors’ agreement for the international division, ...

-

Article

ArticlePikolinos aims to be a leader in sustainability

Pikolinos decided in January to adopt a new corporate structure giving to the three children of the founder Juan Perán Ramos full control of the Spanish footwear company, which is expected to end the fiscal year finishing in April 2022 with revenues of around €100 million. Under the new organization, ...

-

Article

ArticleACBC plans an IPO within two years

ACBC, a fast-growing Italian B Corporation which focuses on sustainable footwear, aims to be listed on the New York Stock Exchange within the next two years. In an exclusive interview with Shoe Intelligence, Gio Giacobbe, who founded the company in 2017 with Edoardo Iannuzzi, explained that the company has preferred ...

-

Article

ArticleScarpe & Scarpe debt restructuring scheme approved by creditors

The large majority, 87 percent, of creditors of the Italian footwear retailer Scarpe & Scarpe have approved the company’s debt restructuring scheme. The plan was approved by all preferential, or Class-1, creditors such as the Italian tax authority, the customs office and social security, and by 83 percent of unsecured, ...

-

Article

ArticleLanvin Group to be listed in New York by merging with a SPAC

Lanvin Group, the Chinse luxury goods group formerly known as Fosun Fashion Group, has entered into a merger agreement with Primavera Capital Acquisition Corporation (PCAC), a special purpose acquisition company (SPAC) listed on the New York Stock Exchange. The transaction values Lanvin Group at a pro forma enterprise value of ...

-

Article

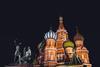

ArticleGerman shoemakers write off the Russian market

The Russian invasion of Ukraine has affected the businesses of many German shoe and leather goods manufacturers, which had been built up over the past few years. “The consequences of this massive unrest are not foreseeable at this point in time,” said Manfred Junkert, general manager of HDS/L, the federal ...

-

Article

ArticleLi Ning excluded from Norway’s sovereign fund

The Chinese sportswear company Li Ning has been excluded from Norway’s sovereign fund, Norwegian Government Pension Fund Global, because of possible links to alleged human rights abuses in the Chinese province of Xinjiang, said the Norwegian central bank, Norges Bank, which manages the fund. The fund’s Council on Ethics recommended ...

-

Article

ArticleSnipes with second major acquisition in the U.S. since December

Snipes continues its expansion in the U.S. with the acquisition of New England-based sneaker retailer Expressions, which operates 35 stores in Massachusetts, Connecticut and Rhode Island. Terms of the deal were not disclosed. Expressions was founded in 1989 as a fashion-oriented family business. In the years that followed, the company ...

-

Article

ArticleSberBank pulls out of the EU

The Russian leader SberBank is withdrawing from the European market, after being hit by massive financial sanctions in retaliation for Russia’s invasion of Ukraine. “Sberbank has decided to withdraw from the European market. The group’s subsidiary banks face abnormal outflows of funds and threats to the security of their employees ...

-

Article

ArticleScarpe & Scarpe plans to continue on its own

The Italian footwear retailer Scarpe & Scarpe, which is currently under a creditor protection scheme, plans to remain independent. The company will outline its business plan and debt repayment proposal to creditors on Feb. 28. The retailer was created in 1961 in Turin and currently has 137 stores across Italy. ...

-

Article

ArticleHow supply disruption, inflation impact Valleverde’s international expansion

Valleverde, the Italian brand of comfort shoes, was a household name in its home country, underpinned by a vast network of directly-operated and franchised mono-brand stores and high-profile advertising campaigns featuring domestic and international celebrities such as the winners of the Miss Italia beauty contest and the Hollywood star Kevin ...

-

Article

ArticleExpo Riva Schuh parent invests €25m to upgrade its exhibition center

Riva del Garda Fierecongressi is investing €25 million to upgrade the exhibition center where is organized twice a year Expo Riva Schuh & Gardabags, the footwear and accessories exhibition held in Riva del Garda, Italy. The company has already spent €9 million to buy hall D of the exhibition complex. ...

-

Article

ArticleRussian bank takes over Stockmann to boost its e-commerce business

SberBank has signed a binding agreement to buy a 100 percent stake in the Russian fashion retailer Stockmann during the first half of 2022. The Russian bank plans to combine the retailer with its own multi-category marketplace, SberMegaMarket. The investment will be made “after conducting a comprehensive investment review” and ...

-

Article

ArticleAmerican Exchange Group acquires Aerosoles

American Exchange Group (AX Group) has finalized an agreement to acquire the assets of the luxury comfort footwear brand Aerosoles. With the takeover, AX Group will expand Aerosoles’ distribution channels and diversify the brand into new categories with the objective of reaching new audiences. “Our strategy is to have the ...

-

Article

ArticleNice Footwear buys the handbag producer Emmegi

Nice Footwear has bought an 80 percent stake in Emmegi, a producer of premium handbag located near Padua, from Gianni Mortandello and Antonella Venturini for €480,000. The purchase price is based on an enterprise value of €600,000 for the whole of Emmegi. Nice Footwear has an option to buy the ...

-

Article

ArticleHow Nice Footwear structured the takeover of Favaro

Following the initial public offering (IPO) of Nice Footwear, which completed on Nov. 18, 2021, we have carried out an in-depth study of the company’s strategy, focusing on its acquisition of Favaro Manifattura Calzaturiera in June last year and its plans to develop the Italian producer of high-end women’s shoes. ...