The market situation seems to be improving almost everywhere

That's what has transpired from the statistics and forecasts that we have read or heard over the past few days about the economy in general, the fashion sector or its footwear segment. The U.K. was the only notable exception, due evidently to the lingering efects of the Brexit vote in ...

SIGN-IN if you are already a subscriber of Shoe Intelligence.

Subscribe today

Your membership benefits:

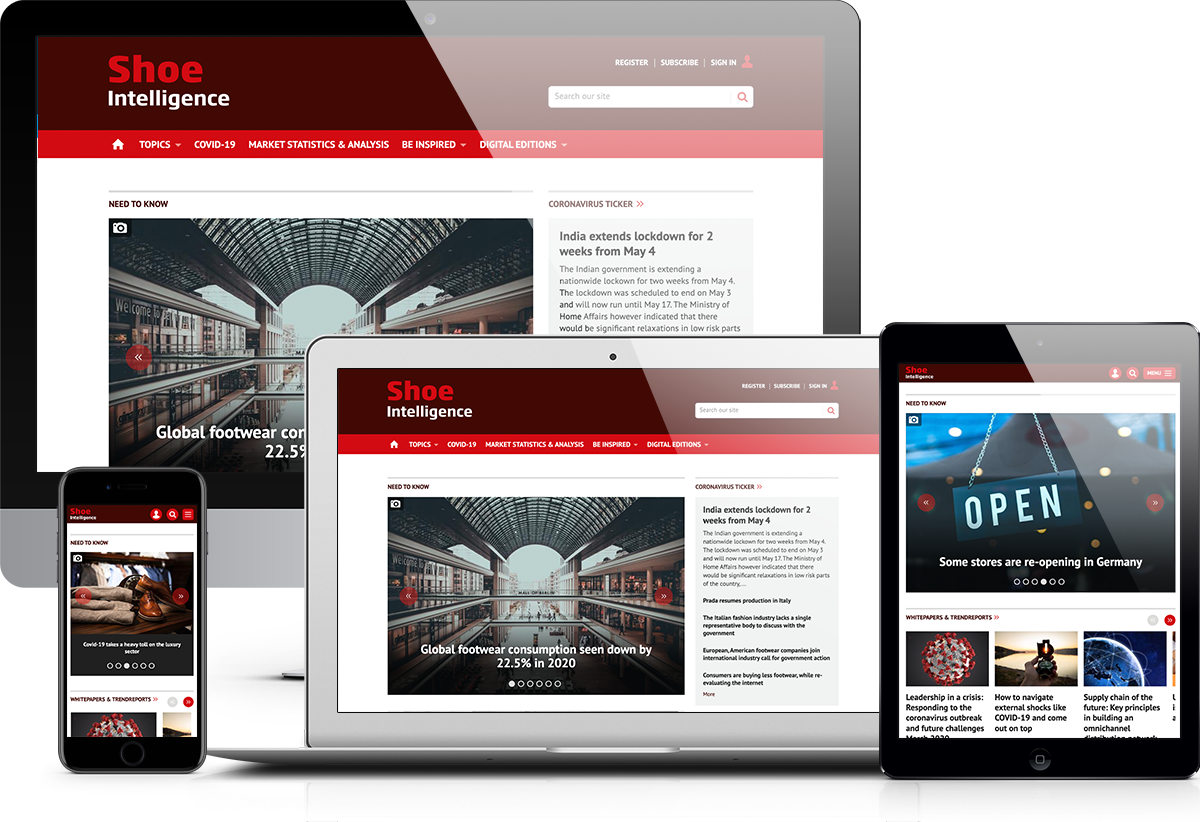

- Unlimited access to shoeintelligence.com - all insight, analysis and statistics 24h/day available online

- Our executive edition of Shoe Intelligence (Digital Edition) - the must-read for all decision-makers in the industry

- Weekly E-mail Briefing from the Chief Editor with the lastest analysis and most important industry developments

- Case studies and best practices on business challenges

- Guest chronicles, interviews, insights from industry experts and leaders that are shaping the future of the industry

- Unlimited access to shoeintelligence.com - all insight, analysis and statistics 24h/day available online

- Powerful search and access to over 16,500 articles and analyses in the archive

- Personal library to save articles and track your key content

- Organisation-wide access across offices, people and devices

To continue reading this article REGISTER NOW.